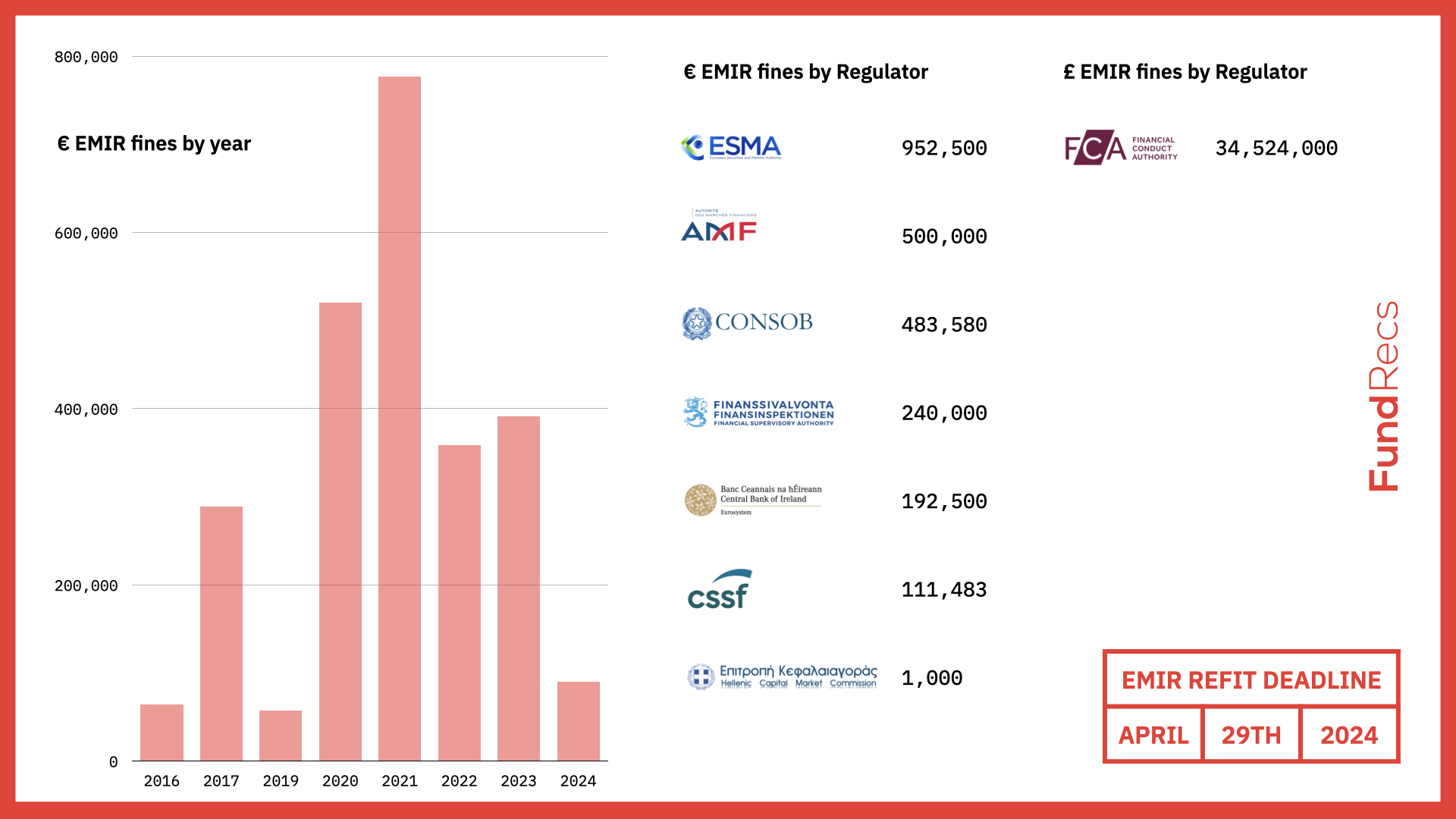

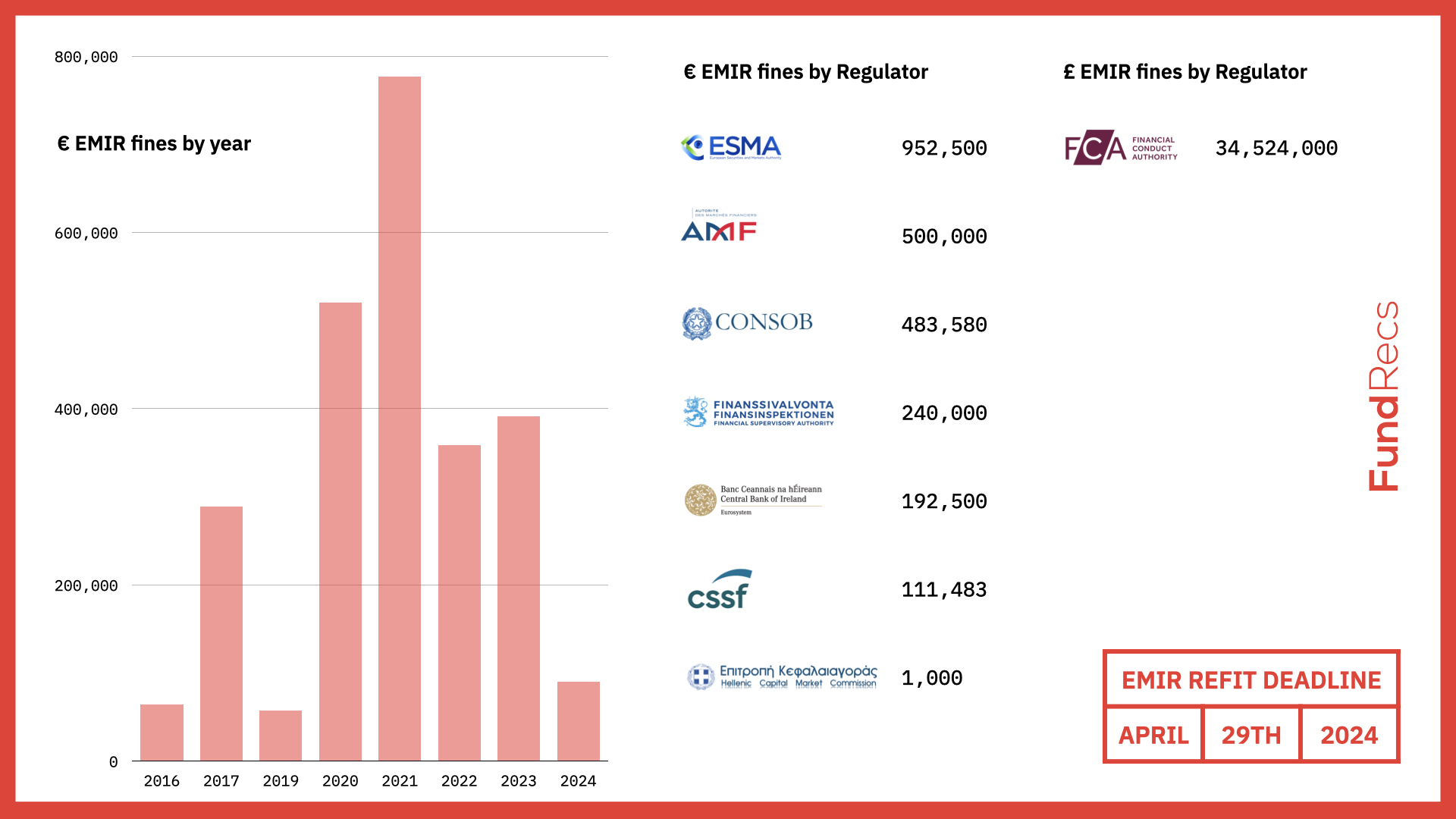

We've put together a Complete History of EMIR Fines. Drop me an email if we missed any: alan@fundrecs.com

Click the links below to view fine details or scroll down for the full timeline:

2024

- January - Finanssivalvonta (FSA) issues fine - €90,000

2023

- November - Central Bank of Ireland (CBI) issues fine - €192,500

- June - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €60,000

- February - Finanssivalvonta (FSA) issues fine - €90,000

- January - Commission de Surveillance du Secteur Financier (CSSF) - €49,083

2022

- August - Finanssivalvonta (FSA) issues fine - €60,000

- March - European Securities and Markets Authority (ESMA) issues fine - €186,000

- March - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €70,000

- March - Commission de Surveillance du Secteur Financier (CSSF) - €42,400

2021

- December - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - not disclosed

- September - European Securities and Markets Authority (ESMA) issues fine - €238,500

- July - European Securities and Markets Authority (ESMA) issues fine - €408,000

- January - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €35,000

- January - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €30,000

2020

- January - Autorité des Marchés Financiers (AMF) - €500,000

- January - Commission de Surveillance du Secteur Financier (CSSF) - €20,000

2019

- July - European Securities and Markets Authority (ESMA) issues fine - €56,000

- May - Hellenic Capital Market Commission (HCMC) - €1,000

2017

- October - Financial Conduct Authority (FCA) - £34,524,000

- July - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €30,000

- June - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €44,980

- June - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €203,100

- June - Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €10,500

2016

- March - European Securities and Markets Authority (ESMA) issues fine - €64,000

Finanssivalvonta (FSA) issues fine - €90,000

The Finnish Financial Supervisory Authority (FIN-FSA) has imposed a €90,000 administrative fine on pension provider Keva. Agreements on the transfer or delegation of EMIR reporting were not concluded with four counterparty banks. This resulted in unreported derivatives contracts from the counterparties, while Keva had not undertaken EMIR reporting itself.

Date - 24/01/2024

Regulator - Finanssivalvonta (FSA)

Fine Amount - €90,000

FSA Link - Administrative fine imposed on Keva for failures in reporting derivative contracts: link

Press Coverage - FIN-FSA imposes fine on Keva link

Central Bank of Ireland (CBI) issues fine - €192,500

The Central Bank has fined investment fund GlobalReach Multi-Strategy ICAV €192,500 for a breach of its reporting obligation under the European Markets Infrastructure Regulation (EMIR). This obligation requires details of any derivative contracts to be reported to a registered trade repository no later than the working day following the conclusion of the contract. The ICAV admitted that it failed to report 200,640 derivative trades entered into between January 2018 and May 2020 by one of its sub-funds to a trade repository.

Date - 28/11/2023

Regulator - Central Bank of Ireland (CBI)

Fine Amount - €192,500

CBI Link - GlobalReach Multi-Strategy ICAV fined €192,500 and reprimanded by the Central Bank of Ireland for breach of its reporting obligation under EMIR: link

Press Coverage - Central Bank fines GlobalReach Multi-Strategy ICAV for breach of regulation link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €60,000

A administrative fine of 60,000 euros. This is what CONSOB decided on 14 June 2023 with resolution 22736 against Banca Sella Holding. In detail it is a pecuniary administrative sanction against for violation of the art. 9, paragraph 1, of Regulation (EU) no. 648/2012 of the European Parliament and of the Council on OTC derivative instruments, central counterparties and trading data repositories and the related implementing regulations.

Date - 14/06/2023

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €60,000

CONSOB Link - Banca Sella Holding spa fined by CONSOB: link

Press Coverage - Banca Sella Holding, the administrative sanction arrives from Consob link

Finanssivalvonta (FSA) issues fine - €60,000

Financial Supervisory Authority imposes administrative fine on Bank of Åland for inadequate reporting on derivative contracts. According to the Financial Supervisory Authority (FIN-FSA), Bank of Åland did not verify the performance of its reporting related to its derivatives contracts with adequate care in accordance with applicable law.

Date - 27/02/2023

Regulator - Finanssivalvonta (FSA)

Fine Amount - €60,000

FSA Link - Administrative fine imposed on Bank of Åland Plc for failures in reporting on derivatives contracts: link

Press Coverage - Financial Supervisory Authority Imposes Administrative Fine on Bank of Åland for Inadequate Reporting on Derivative Contracts link

Commission de Surveillance du Secteur Financier (CSSF) - €49,083

The CSSF imposed two fines on Invesco: one of 18,878 euros linked to the management of conflicts of interest and a second of 30,205 euros for breaches of reporting obligations for derivative contracts. Double penalty for Invesco Real Estate Management. The Financial Sector Surveillance Commission (CSSF) announced in a document dated May 26 that it had imposed two fines against the investment fund manager.

Date - 31/01/2023

Regulator - Commission de Surveillance du Secteur Financier (CSSF)

Fine Amount - €49,083

CSSF Link - Administrative sanctions imposed on the investment fund manager Invesco Real Estate Management S.à r.l.s: link

Press Coverage - The CSSF sanctions Invesco with a fine of 49,083 euros: link

Finanssivalvonta (FSA) issues fine - €60,000

The FIN-FSA has imposed an administrative fine of EUR 60,000 to S-Bank Plc. In the period from June 2019 to March 2021, the bank has neglected its obligation to ensure that details of all derivatives contracts it concludes are reported to a trade repository in accordance with regulation.

Date - 24/08/2022

Regulator - Finanssivalvonta (FSA)

Fine Amount - €60,000

FSA Link - Administrative fine imposed on S-Bank Plc for failures in reporting on derivatives contracts: link

Press Coverage - Financial Supervisory Authority imposes administrative fine on S-Bank for inadequate reporting on derivative contracts: link

European Securities and Markets Authority (ESMA) issues fine - €186,000

Luxembourg-based trade repository REGIS-TR has been fined €186,000 by the European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, for eight breaches of the European Market Infrastructure Regulation (EMIR).

Date - 24/03/2022

Regulator - European Securities and Markets Authority (ESMA)

Fine Amount - €186,000

ESMA Link - ESMA fines Regis-TR €186 000 for EMIR data breaches: link

Press Coverage - REGIS-TR fined by ESMA for EMIR data reporting breaches: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €70,000

An administrative fine of €70,000.00 is applied to Banco BPM SpA.

Date - 24/03/2023

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €70,000

CONSOB Link - Banca BPM Spa fined by CONSOB: link

Commission de Surveillance du Secteur Financier (CSSF) - €42,400

On 11 March 2022, the CSSF imposed an administrative fine amounting to EUR 42,400 on the investment fund manager Generali Investments Luxembourg S.A. (the “Manager”) subject to Chapter 15 of the amended Law of 17 December 2010 relating to undertakings for collective investment and authorised as alternative investment fund manager according to the provisions of the amended Law of 12 July 2013 on alternative investment fund managers.

Date - 11/03/2022

Regulator - Commission de Surveillance du Secteur Financier (CSSF)

Fine Amount - €42,400

CSSF Link - Administrative sanction imposed on the investment fund manager Generali Investments Luxembourg S.A.: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - not disclosed

Commissione Nazionale per le Societa e la Borsa (CONSOB) issued a fine under EMIR but the recipient and other details like amount are omitted from the registrar which can be clicked on below.

Date - 27/12/2021

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - not disclosed

CONSOB Link - Entity fined by CONSOB: link

European Securities and Markets Authority (ESMA) issues fine - €238,500

rade depository UnaVista has been fined €238,500 by European Securities and Markets Authority (ESMA) for eight breaches of the European Market Infrastructure Regulation (EMIR).According to the regulator, between 2016 and 2018 UnaVista failed to ensure the integrity of its data by providing incorrect field ordering logic, mapping rules and crossed date boundaries.

Date - 23/09/2021

Regulator - European Securities and Markets Authority (ESMA)

Fine Amount - €238,500

ESMA Link - ESMA fines UnaVista trade repository €238,500 for EMIR data failures: link

Press Coverage - ESMA orders UnaVista to pay €238k for EMIR data breaches: link

European Securities and Markets Authority (ESMA) issues fine - €408,000

rade depository UnaVista has been fined €238,500 by European Securities and Markets Authority (ESMA) for eight breaches of the European Market Infrastructure Regulation (EMIR).According to the regulator, between 2016 and 2018 UnaVista failed to ensure the integrity of its data by providing incorrect field ordering logic, mapping rules and crossed date boundaries.

Date - 12/07/2021

Regulator - European Securities and Markets Authority (ESMA)

Fine Amount - €408,000

ESMA Link - DTCC Derivatives Repository fined €408,000 for EMIR data breaches: link

Press Coverage - DTCC Derivatives Repository fined €408,000 for EMIR data breaches: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €35,000

An administrative fine of €35,000.00 is applied to BANCA ALETTI & CSPA.

Date - 27/01/2021

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €35,000

CONSOB Link - BANCA ALETTI & CSPA fined by CONSOB: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €30,000

An administrative fine of €30,000.00 is applied to BANCA AKROS SPA.

Date - 27/01/2021

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €30,000

CONSOB Link - BANCA AKROS SPA fined by CONSOB: link

AMF Sanctions Commission sanctions BRED Banque Populaire - €500,000

In its decision of January 24, 2020, the Sanctions Commission imposed a penalty of 500,000 euros on the company BRED Banque Populaire for violation of several of its professional obligations applicable to OTC derivatives transactions, resulting from the European EMIR regulation.

Date - 24/01/2020

Regulator - Autorité des Marchés Financiers (AMF)

Fine Amount - €500,000

AMF Link - The AMF Sanctions Commission sanctions for the first time an investment services provider for breaches of its professional obligations arising from the European EMIR regulation: link

Press Coverage - Bred is sanctioned in its market activities: link

Commission de Surveillance du Secteur Financier (CSSF) - €20,000

Financial Supervisory Authority imposes administrative fine on Bank of Åland for inadequate reporting on derivative contracts. According to the Financial Supervisory Authority (FIN-FSA), Bank of Åland did not verify the performance of its reporting related to its derivatives contracts with adequate care in accordance with applicable law.

Date - 17/01/2020

Regulator - Commission de Surveillance du Secteur Financier (CSSF)

Fine Amount - €20,000

CSSF Link - Administrative sanction imposed on the investment fund manager Edmond de Rothschild Asset Management (Luxembourg) S.A.: link

Press Coverage - Edmond de Rothschild AM fined by Lux regulator over reporting: link

European Securities and Markets Authority (ESMA) issues fine - €56,000

Trade repository Regis-TR gets a €56,000 fine by ESMA for ”negligently” failing to provide regulators with immediate access to derivative contract details. According to a recent press release from the European Securities and Markets Authority (ESMA), the fine relates to access failures stemming from a lack of capable systems from 2014 to 2016.

Date - 15/07/2019

Regulator - European Securities and Markets Authority (ESMA)

Fine Amount - €56,000

ESMA Link - ESMA fines Regis-TR S.A. €56,000 for data access failures: link

Press Coverage - ESMA fines Regis-TR for access failures: link

Hellenic Capital Market Commission (HCMC) issues fine - €1,000

An administrative fine of €1,000 is applied to ARDU PRIME AEPEY, previously MAGNA TRUST AEPEY.

Date - 30/05/2019

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €1,000

CONSOB Link - ARDU PRIME AEPEY, previously MAGNA TRUST AEPEY by HCMC: link

Financial Conduct Authority (FCA) - £34,524,000

Britain's financial watchdog has fined Bank of America's Merrill Lynch investment banking arm 34.5 million pounds for its third transaction reporting failure in just over a decade.

The Financial Conduct Authority said the bank failed to have adequate oversight arrangements, undertake testing or allocate enough staff to properly meet reporting obligations for derivatives trading between February 2014 and February 2016.

Date - 18/10/2017

Regulator - Financial Conduct Authority (FCA)

Fine Amount - £34,524,000

FCA Link - FCA fines Merrill Lynch £34.5 million for failing to report transactions: link

Press Coverage - UK watchdog fines Merrill Lynch 34.5 million pounds for reporting failure: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €30,000

An administrative fine of €30,000.00 issued.

Date - 26/07/2017

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €30,000

CONSOB Link - BANCA AKROS SPA fined by CONSOB: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €44,980

An administrative fine of €44,980 issued.

Date - 27/01/2021

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €44,980

CONSOB Link - BANCA AKROS SPA fined by CONSOB: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €203,100

An administrative fine of €203,100 issued.

Date - 21/06/2017

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €203,100

CONSOB Link - BANCA AKROS SPA fined by CONSOB: link

Commissione Nazionale per le Societa e la Borsa (CONSOB) issues fine - €10,500

An administrative fine of €10,500 issued.

Date - 21/06/2017

Regulator - Commissione Nazionale per le Societa e la Borsa (CONSOB)

Fine Amount - €10,500

CONSOB Link - BANCA AKROS SPA fined by CONSOB: link

European Securities and Markets Authority (ESMA) issues fine - €64,000

Europe’s top markets regulator has fined the Depository Trust & Clearing Corporation for failing to provide regulators with direct access to data in its trade repository – the largest of its kind in Europe. The European Securities and Markets Authority issued the €64,000 fine on March 31. The fine is the first of its kind against a trade repository, according to an Esma spokesman.

Date - 31/03/2016

Regulator - European Securities and Markets Authority (ESMA)

Fine Amount - €64,000

ESMA Link - ESMA fines DTCC Derivatives Repository Limited €64,000 for data access failures: link

Press Coverage - Esma fines DTCC for European trade repository failings: link

.png)

.png)

.png)

.png)