Resources

Stay up to date with the latest news, articles, and opinion from Fund Recs, designed to keep you informed and ahead in managing, moving and reconciling fund data at scale.

Latest from Fund Recs

Global coverage, local precision

Discover the latest OTC derivatives regulatory updates in Hong Kong and Canada, and learn how to stay compliant with new reporting and risk management standards.

Read Post

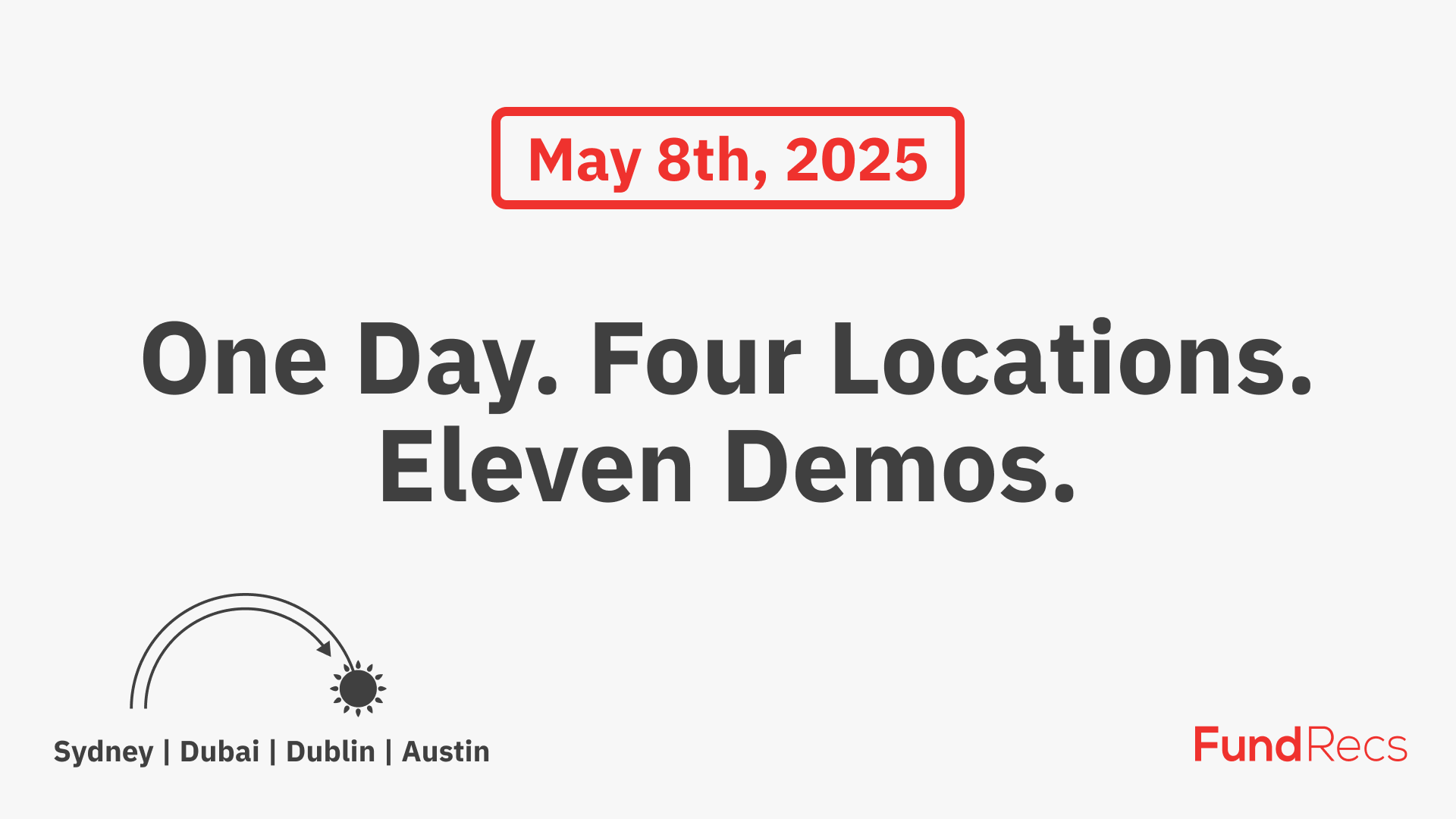

Fund Recs Global Demo Day

Ensure accurate NAV oversight with Fund Recs' automated solutions for data reconciliation and regulatory compliance, enhancing operational efficiency and investor trust in the fund industry.

Read Post

Why NAV Oversight Matters

Ensure accurate NAV oversight with Fund Recs' automated solutions for data reconciliation and regulatory compliance, enhancing operational efficiency and investor trust in the fund industry.

Read Post

Alchelyst partners with Fund Recs to elevate Fund Operations through Innovation

Alchelyst partners with Fund Recs to enhance fund operations through innovative reconciliation software, addressing industry challenges and modernizing alternative fund servicing.

Read Post

Adminovate 2025: Where AI Meets Investment Management

Explore how AI is transforming investment management at Adminovate 2025. Join industry leaders for insights, discussions, and connections. Get your tickets now.dm

Read Post

Hong Kong’s OTC Derivatives Rules: What You Need to Know for 2025

Learn about Hong Kong's new 2025 OTC derivatives regulations and what firms need to do to stay compliant.

Read Post-

Whitepaper

Automating Fund of Funds Reconciliations

Get a detailed insight into the current state of Fund of Fund reconciliations. Find out why some of these are still being completed manually and discover the main challenges of reconciling Fund of Funds. This whitepaper also investigates the associated risks and how to address them.

Latest news

Client News

Client News

Alchelyst partners with Fund Recs to elevate Fund Operations through Innovation

Alchelyst partners with Fund Recs to enhance fund operations through innovative reconciliation software, addressing industry challenges and modernizing ...

Read Post Client News

Client News

GemCap Partners with Fund Recs for Advanced EMIR Solution

GemCap partners with Fund Recs to enhance regulatory compliance through advanced EMIR reconciliation solutions, ensuring seamless adherence to evolving ...

Read Post Data Reconciliation

Data Reconciliation

SuMi TRUST adds Fund Accounting Solution from Fund Recs

SUMI Trust has adopted Fund Recs fund accounting reconciliation solution, marking a significant step in enhancing financial operations.

Read PostSubscribe to our newsletter

Subscribe to our newsletter for the latest news from Fund Recs.