Ensure your reporting meets the complete, accurate and timely standard using automated data ingestion, rules-based matching, a powerful data quality check and customised reporting for all of your stakeholders.

Automate data ingestion

- Daily data quality checks performed on the Trade Repository data to give you oversight over all transactions submitted.

- Reconciliation between the Trade Repository and the Book of Records to ensure completeness, accuracy and timeliness.

- Connectivity with Trade Repositories to ingest reported data, as well as 50+ Books of Record file types pre-mapped.

Reliable reporting solved

- Access to our Regulatory Working Groups to discuss treatment of the regulations, with input from industry peers, Fund Recs and the regulator.

- Reporting suite to cover in-house reporting requirements as well as Governance reports for senior management and Boards.

- Continuous upgrades to ensure our Oversight solution covers your regulatory obligations.

Take Action. Drive Results.

With decades of experience, we've seen it all. See how we add value around the edges.

Audit trails

EMIR oversight is an important regulatory requirement. Having a robust audit process is essential. Every action is tracked and audit trails created.

Custom reporting

Customisable and configurable output reports can be set up to meet your needs and can be defined by investment manager, fund, counterparty, administrator, team, or region.

Moral support

Our clients all become members of our EMIR Working Group and get the opportunity to problem solve (and counsel each other!) as an industry with their peers.

More please

Want to know more before talking to one of the Fund Recs team? We understand and we've got what you need.

Visit our FAQ section here.

Trusted by industry-leading companies worldwide

Resources

Everything you need to know - the latest webinars, whitepapers, and blog articles.

SuMi TRUST chooses Fund Recs for EMIR Solution

Dublin, April 18th, 2024 - We're pleased to share that SMT Fund Services (Ireland) Limited (“SMT”) has chosen Fund Recs for our innovative EMIR reconciliation solution. This decision highlights SMT’s...

Read Post

Maples Group Enhances EMIR Reconciliations with Fund Recs

Dublin, May 10th 2024 - Fund Recs, a leading provider of cloud-based reconciliation software for the global funds industry, is excited to announce that the Maples Group has integrated its innovative...

Read Post

Navigating EMIR Refit 2024: 6 Key Considerations

The European Market Infrastructure Regulation (EMIR) Refit, set to come into effect on 29th April 2024, introduces several changes. In December of last year, ESMA released the final report on...

Read Post

ASIC Basics: Part one

Introduction The Australian Securities and Investments Commission (ASIC) is rolling out game-changing updates to over-the-counter (OTC) derivative transaction reporting, effective from 21 October...

Read Post

EMIR Re-fit: Lessons Learned

Looking back on the European OTC derivative transaction reporting re-write as the mirror Australian ASIC deadline in October fast approaches. Within the world of derivative transaction reporting, for...

Read Post

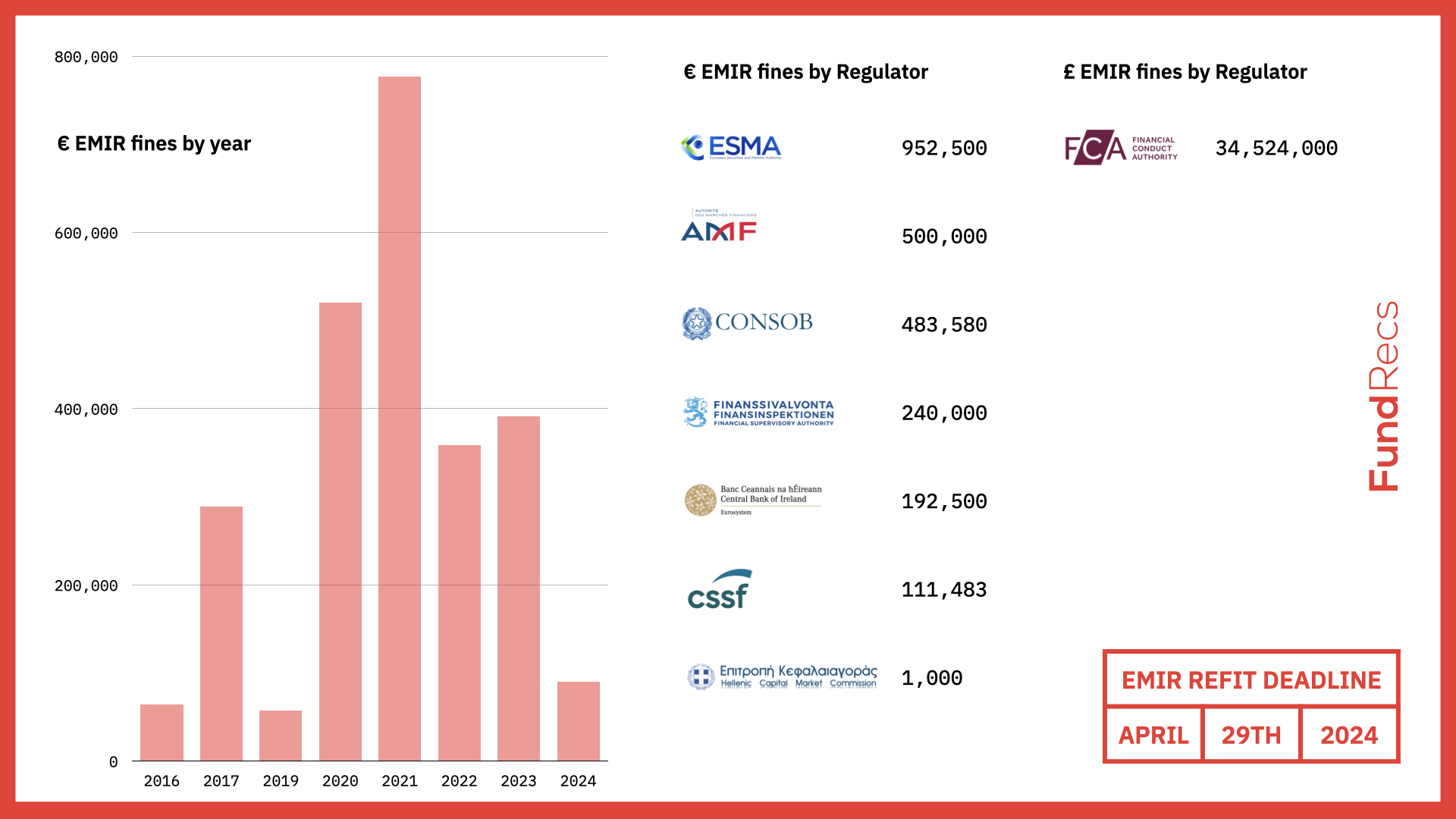

A Complete History of EMIR Fines

We've put together a Complete History of EMIR Fines. Drop me an email if we missed any: alan@fundrecs.com

Read Post